Pennsylvania Special Purpose Entities FAQ

No, the REV-1123 was submitted to the DOR prior to your K-1 being sent.

No, you do not need to submit your K-1 with your federal return. Our CPA, Trout CPA, has filed all K-1 documents with the IRS.

Yes, in order for us to complete your K-1 document and submit the Tax Form Rev-1123 for the Special Purpose Entity you are contributing through to the State of Pennsylvania you must provide your social security number. The PA DOR will match the social security number provided on REV-1123 with your tax return. If you have concerns about listing this information on your joinder agreement, please reach out to a program specialist for additional options of providing your social security number.

Your funds are directed to the school of your choice for student scholarships. We will notify your school as soon as the Special Purpose Entity is closed, and funds are available.

ACH Contributions are processed at the end of each business day and can take up to 24-48 hours before reflecting on your financial institution’s account. Your ACH payment will show up on your account as ‘Association of Christian‘ or an abbreviation of this.

You will receive a state tax credit for 90% of your contribution. This cannot exceed your Pennsylvania tax liability. The additional 10% can be counted as a charitable contribution on your federal return.

We are happy to provide you the resources and talking points necessary to share this program with others. We are also available to answer questions every Wednesday from 11 am – 12 noon EST: Join Here

If you’re unable to join our weekly meeting, you can also contact us at ctf@acsi.org to setup a virtual meeting that better meets your schedule.

Contributions for the tax year may be due prior to receiving your previous refund due to state mandated SPE deadlines. If you have additional concerns, please reach out to your program specialist.

The REV-1123 was submitted to the Department of Revenue and recorded prior to your K-1 being sent. If you receive a letter, please email a copy to CTF_SPE@acsi.org and a CTF member will reach out to our contact at the state to have the issue resolved. If you are a participating business that received this letter and you are passing down credits to an individual, you must have submitted an REV-1123 from your business. Please email CTF_SPE@acsi.org and we can reach out to the state to see if this is the information that is needed.

You will be placed in a waitlist que and a program specialist will reach out to you to let you know it was received from CTF_SPE@acsi.org. If you have sent it in and have not received an acknowledgement email within 24 hours, please check your spam folder or reach out to a program specialist at CTF_SPE@acsi.org.

Spring General Timeframe:

1. First Week of January: We will check in with you to confirm that the amount of your tax-credit reservation has not changed.

2. First week of February: You will then receive an email from us with your executed joinder that includes the SPE name (special purpose entity: an avenue that the state uses for individuals to receive a tax-credit) and a contribution link.

3. Mid/Late February: Your K-1 document, and blank schedule OC will be securely emailed to you to file with your PA Individual Income Tax Forms.

4. First Week of April: Contribution will be due. Actual dues date will be listed when payment link is sent.

Fall General Timeframe:

1. Mid July: We will check in with you to confirm that the amount of your tax-credit reservation has not changed.

2. September: You will then receive an email from us with your executed joinder that includes the SPE name (special purpose entity: an avenue that the state uses for individuals to receive a tax-credit) and a contribution link.

3. End of October: Contribution will be due. Actual dues date will be listed when payment link is sent.

4. Mid/Late February: Your K-1 document, blank schedule OC will be securely emailed to you to file with your PA Individual Income Tax Forms.

On line 7 of the PA Schedule OC fill in the following: Credit Description Code – PT (credits are being received from a pass-through entity), Awardee Tax ID Number – Listed on page 2 of your K-1 in Part 1, Box A. This is the Partnerships employer identification number – Number 7 – enter the amount of credit you are utilizing that was passed through to you from the SPE found on line 18 of your K-1.

If you are part of the Berks Christian School Scholarship Partners, LLC SPE you will fill in line 8 as this is an OSTC SPE.

You will need to submit your full K-1 document and complete a PA Schedule OC. Sample Schedule OC (link this to sample document)

We accept ACH or Check payment. You will receive a secure contribution link to make your payment. If you are paying by check, we do ask that you send a picture of the check that is being mailed. This information can be sent through a secure link provided by your program specialist. We also highly recommend sending your payment with some form of tracking for your security and peace of mind.

Funds for the school will be held until all contributions for the Special Purpose Entity (SPE) you are participating in have been received and the SPE has been closed. We are unable to close out a SPE until every contributor who has agreed to participate has made their contribution.

If you do not have a school designation, you may select our General Fund. There are many schools with students who have a great need. Your contribution could help those students attend or stay at a school of their choice!

Our minimum contribution amount is $1,000 and we do not have a cap on maximum contribution amounts so long as it meets your maximum tax liability.

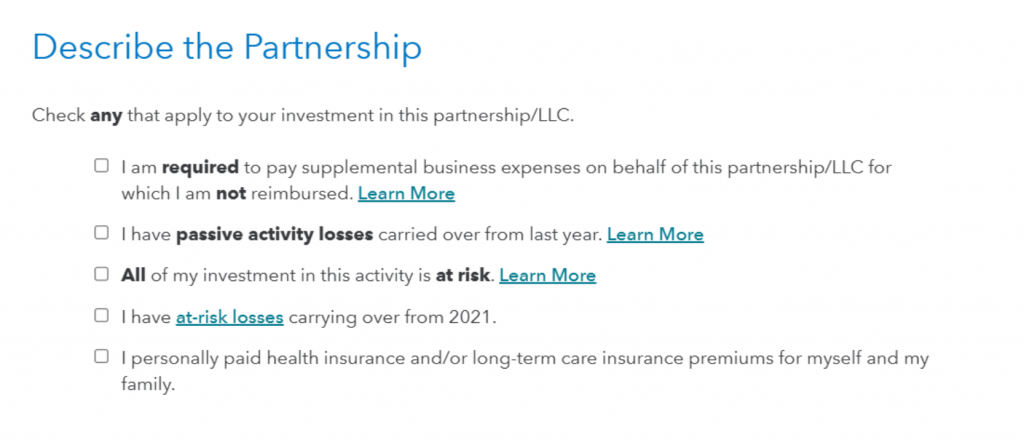

If you are asked the following question when completing your return, you should be able to leave this blank and move on to the next question.

Special Purpose Entities have until March 15th to issue your K-1 tax document. Your K-1 will be sent via secure email usually by the end of February but no later than March 15th.

Information listing other credits when filing your return using Turbo Tax can be found here: https://ttlc.intuit.com/community/state-taxes/discussion/i-have-a-tax-credit-that-needs-to-be-filed-on-pennsylvania-schedule-oc-can-that-be-done-on-turbo-tax/00/1379977/amp

- Due to the additional step of verifying the credits on your return you may find your tax-return takes longer for the state to process than before. The PA DOR has stated that taxpayers who are claiming credits on their return, should expect their refunds in the fall. Here are a few steps that you can take for the most up to date status of your refund: You can check the status of your refund online at https://mypath.pa.gov/_/. Scroll down to the section “Refunds” and click on “Where is My Refund?”

- If you haven’t received your 2022 refund, please email (ctf_spe@acsi.org) with your MyPath id number from your search on the site listed above and we will contact the DOR on your behalf.

We will not be checking for 2023 returns until October